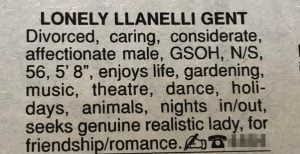

Remember those lonely heart columns in the paper that looked like this…

Now, the man, (let’s call him Dave) who wrote this advert had a clear idea of characteristics his ideal partner must have; a check-list of traits that, if 100% embodied, would, without fail, make the perfect woman for him.

OK, so imagine the scene…

A woman, (let’s call her Angie) having obviously self-qualified herself, responds to the advert and the pair meet in a bar.

30-minutes into the conversation, Dave has asked Angie loads of questions about her interests in gardening, music, theatre, dance, holidays and animals, but there’s a problem…

…Angie hasn’t asked him a single question back.

There are a few awkward silences. In fact, there are loads.

Dave is running out of questions and he begins to realise Angie’s social intelligence isn’t quite up to his, and he fears the worst…

…there’s just no “spark”.

The date ends and they both agree they’d “rather be friends.”

Poor Dave.

And the point is…

Although Dave thought he would find the perfect woman by listing all the things he believed were important, the reality was that their personalities just didn’t gel.

As recruiters, we see this kind of thing all the time.

Companies list a set of “hard skills” they require their new hire to have without giving much thought to the importance of “soft skills”.

And the outcome?

Well, a lot of headaches!

That’s because, even though they’ve hired someone who, on the surface had all the hard skills they thought was needed for the job, in reality, there was so much more that was required, meaning they’re left looking for another person.

So, what’s the difference between hard skills and soft skills?

Hard skills are things that can be learned, like qualifications, IT knowledge, risk analysis, and the skills that are required to get the job done, i.e. their competency.

Soft skills, on the other hand, are the traits that can’t be learnt, (or, at the very most are much trickier to learn) but are equally important to getting the job done well, such as an agreeable personality, decision-making confidence, leadership abilities and work ethic, along with their communication skills and passion, i.e. their compatibility.

In short, competency is nothing without compatibility, and recent studies have disclosed that 89% of people within the recruitment sector highlighted that quite often the reason new hires are failing in their roles is down to their soft skills severely lacking.

Why soft skills should be a major focus for fintech companies…

As an industry that relies on technical ingenuity, both hard and soft skills are required to meet the level of initiative needed to conceive new ideas and execute them brilliantly.

Hard skills = machine-like thinking

Soft skills = human-like thinking

In fact, in a research piece by Harvard University and other parties on the FinTech industry, soft skills were attributed to 85% of success within job roles, with only 15% being attributed to technical or hard skills.

Therefore, it could be argued that soft skills are a far more important element than technical competency when hiring for a new role.

Now of course, you can’t deny that FinTech roles require hard skills – but the soft skills are the driving force in attaining them through attributes such as a positive attitude, team-building skills and eagerness to learn and develop new processes with others as well as independently.

Choose a recruiter who digs deep for those soft skills

In the same way a new recruit needs both the hard and soft skills, so too does your recruiter.

You might be in the unenviable position of finding someone to help you fill a vacant role, and for that, we can only tilt our heads with empathy. It’s tough.

One thing that will help you find that person/company is asking them this question:

“How do you ensure that the candidates you put forward have both the hard and soft skills required for the role? What’s your process?”

And if their answer is anything other than…

“We have a very in-depth qualifying process for our candidates where we assess their competency and compatibility for the role based on the role’s specific requirements and company culture, and ensure that all boxes are ticked and personalities gauged before sending over for your consideration”

…then you’re in trouble.

Syncopate are the “dig deep” kind

With an unwavering focus on understanding our client’s culture and preferred personality profiles before we recruit for the position, it’s safe to say we’re the kind of recruiters who dig deep past those hard skills to ensure the soft skills are there to meet the brief.

Our process for doing this is fail-safe, and it’s why our clients regard us as recruiting partners opposed to CV providers.

If you’d like to know exactly what our process is for ensuring our candidates are both competent and compatible, you’re more than welcome to send us an email at hello@wearesyncopate.com or call us on +44(0) 333 733559 , or alternatively, feel free to check out our website to get a better feel of whether you think our style will gel with yours.

Enagage With Us